Further improved profitability

THE FIRST QUARTER JANUARY – MARCH 2017

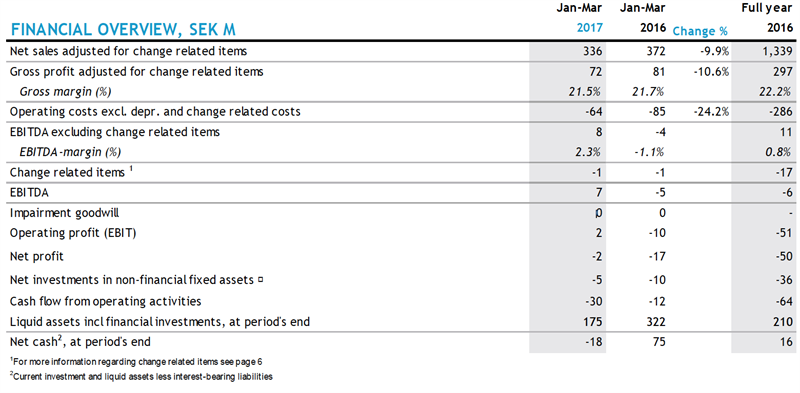

- Net sales amounted to SEK 336 M (372). Net sales adjusted for change related items were SEK 336 M (372), which was a decrease of 10%.

- Gross profit adjusted for change related items was SEK 72 M (81), a decrease of 11% or 10% adjusted for changes in exchange rates. Gross margin adjusted for change related items was 21.5% (21.7).

- Operating costs excluding depreciation and change related items were SEK 64 M (85), a decrease of 24%.

- EBITDA amounted to SEK 7 M (-5). Adjusted for change related items, EBITDA was SEK 8 M (-4).

- Capitalised expenses for product development were SEK 5 M (10).

- Cash flow from operating activities was SEK -30 M (-12) and the sum of cash and interest-bearing financial assets was SEK 175 M (322) at the end of the first quarter. Net cash in the first quarter decreased by SEK 34 M to SEK -18 M.

- Earnings per share, before and after dilution were SEK –0.04 (-0.40).

CEO MATTHIAS STADELMEYER’S COMMENTS

“Tradedoubler’s business focus is on profitability and financial independency. In Q1 we continued the positive financial trend with a significantly improved EBITDA result and further improvements in the business.

In Q1 revenue and gross profit decreased by 10% currency adjusted which is a decline on similar level as in Q4 2016 and significantly improved to the quarters before. This decline is related to the loss of larger, low-margin clients in the UK in the beginning of 2016 and the active closure of unprofitable programs, formerly managed in Telford, in the second half of 2016. The trend in the underlying business continues to improve with positive year over year comparisons. The effect of this trend can be seen in the results of the different regions. For the reasons mentioned above the UK declined significantly compared to the same period last year while all other regions show stable results.

This change in the business mix is reflected as well in the increase of the gross margin over the last quarters. The lower gross margin in Q1 is linked to seasonal effects in verticals with lower margin like travel.

Operational costs decreased by 24% compared to Q1 last year with the improvements in the management and service structure of the company materializing now to a larger extend. We continue the efforts to improve the efficiency of the business.

We focus on offering performance marketing solutions to our clients including all our products – TD CONVERT, TD CONNECT, TD ENGAGE and TD ADAPT. In accordance with changes in the structure of the internal reporting the segment reporting will be on a regional level going forward. Within this solution offering TD ENGAGE contributes now in all regions and develops according to our expectations.

Capitalised costs for product development decreased compared to Q1 last year as we have finalised a number of projects and improved processes and focus.

Cash flow from operating activities was negative due to a larger decrease of working capital which is linked to lower prepayment amounts from clients. As part of our solution offering we offer clients market-standard flexible invoicing terms. This non-recurring impact of reduced prepayment amounts is known and forecasted accordingly.

In Q1 we have launched a new tracking system that is currently rolled out to our clients. The new tracking strengthens our market leading technology position ensuring accurate results and transparency for our clients and flexible and efficient management via a master tag solution.

Since Q1 Tradedoubler systems create user profiles based on our tracking and we are now able to connect these profiles to external systems like media buying platforms and target these users with customized advertising.

The development of further improvements of our platform including new interfaces progresses according to plan with first versions being released in the middle of the year.

The focus on client related activities, additional internal improvements and benefits from our investments into our technology makes me confident to further realise our plans for 2017 and improve our business continuously in the coming quarters.”

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: ir@tradedoubler.com

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 4 May 2017. Numerical data in brackets refers to the corresponding periods in 2016 unless otherwise stated. Rounding off differences may arise.